The data that defined

Quarter 1 of 2023

Discover the top trends, data and statistics

that defined the industry last quarter.

Contents

Highlights & hot topics 🔥

2.6% quarterly growth

Q1 2023 witnessed a 2.6% average week-over-week growth, slow but steady.

13.6% less bookings

Q1 2023 had 13.6% less bookings than Q4 2022.

2.8% more bookings

North America saw 2.8% month-over-month growth last quarter, making it the highest of all regions.

How’s the industry looking in your region? ?

Discover how UK & Ireland, ANZ, North America and Europe performed last quarter.

Next-generation QR booker hits the market ?

Say hi to Taxi Butler’s Guest QR, the next-generation QR taxi booker that generates automated taxi bookings from anywhere inside hotels, bars, and restaurants.

Global taxi booking data 📊

Q1 2023 in context

How does look Q1 2023 look compared to the last 12 months?

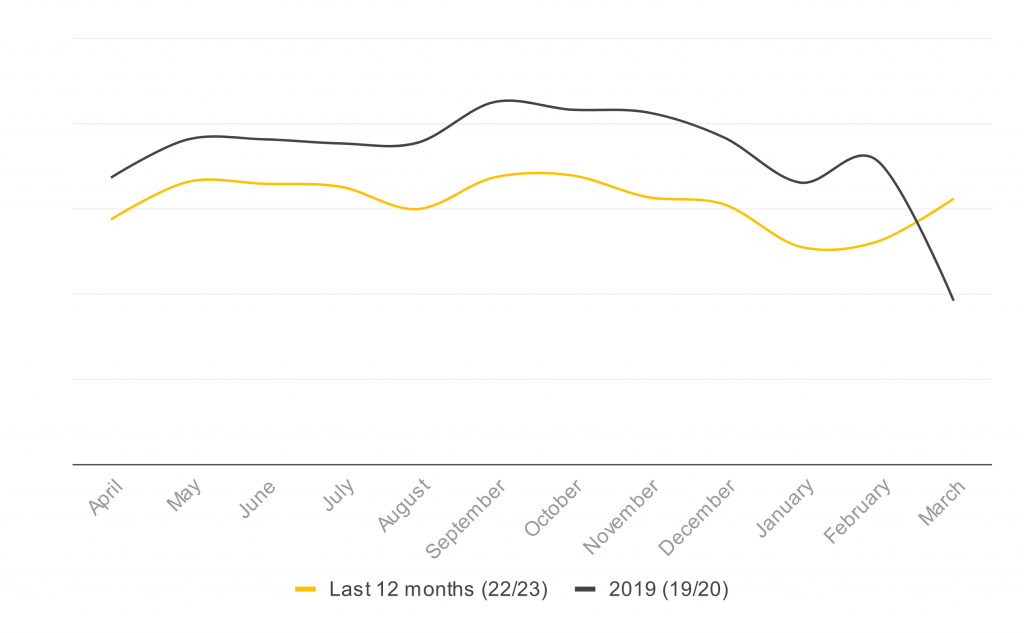

Graph #1: Line chart showing the global B2B taxi bookings from the last 12 months and a comparison line for 2019, the last pre-COVID year.

13.6% less bookings than Q4 2022

Q1 2023 had 13.6% less bookings than Q4 2022.

In fact, Q1 2023 had 12.61% less bookings than Q2 2022, and 13.88% less than Q3 2022.

22.2% more bookings in March

March 2023 had 22.2% more bookings than in Jan 2023.

Between January and February there was a 2.4% increase and a 19.4% increase between February and March.

A deep dive into last quarter

Weekly B2B taxi bookings throughout the quarter

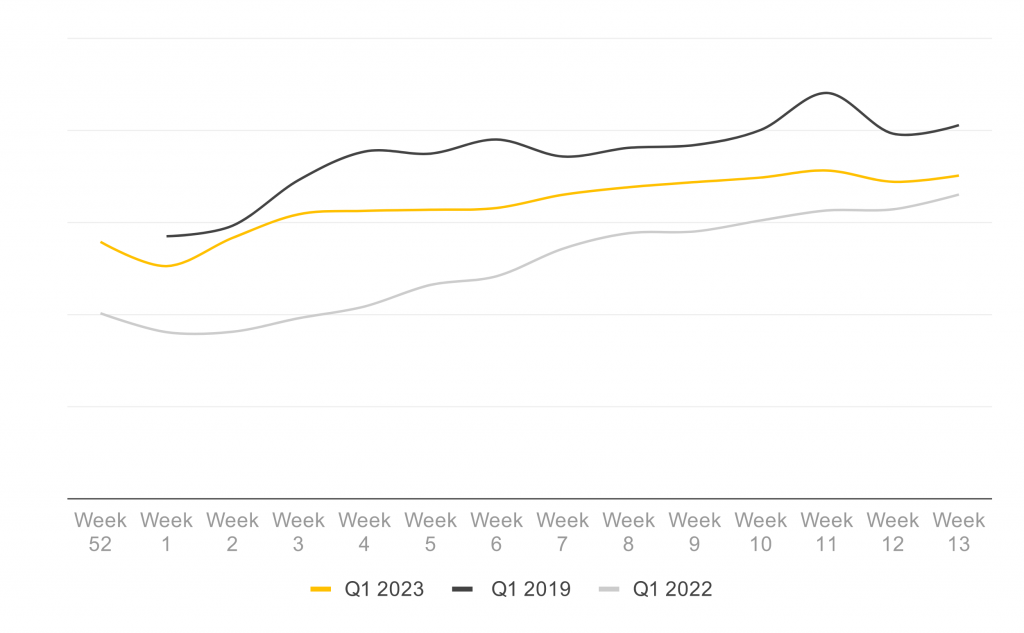

Graph #1: Line chart showing the global B2B taxi bookings from last quarter on a weekly basis and a comparison line for 2019, the last pre-COVID year.

Week 11

Week 11 of last quarter saw the highest number of bookings as compared to other weeks.

Week 1

Week 1 saw the fewest number of bookings. Historically, week 1 is known for having fewest bookings than other weeks.

2.6% growth last quarter

The average week-over-week growth in Q1 2023 was 2.6%. Week 12 was the only week that saw a drop in bookings.

27.6% more than last year

Q1 2023 saw 27.6% more bookings than Q1 2022.

13.7% less than 2019

Q1 2023 saw 13.7% less bookings than Q1 2019.

Best-performing types of venues

Bookings per type of venue

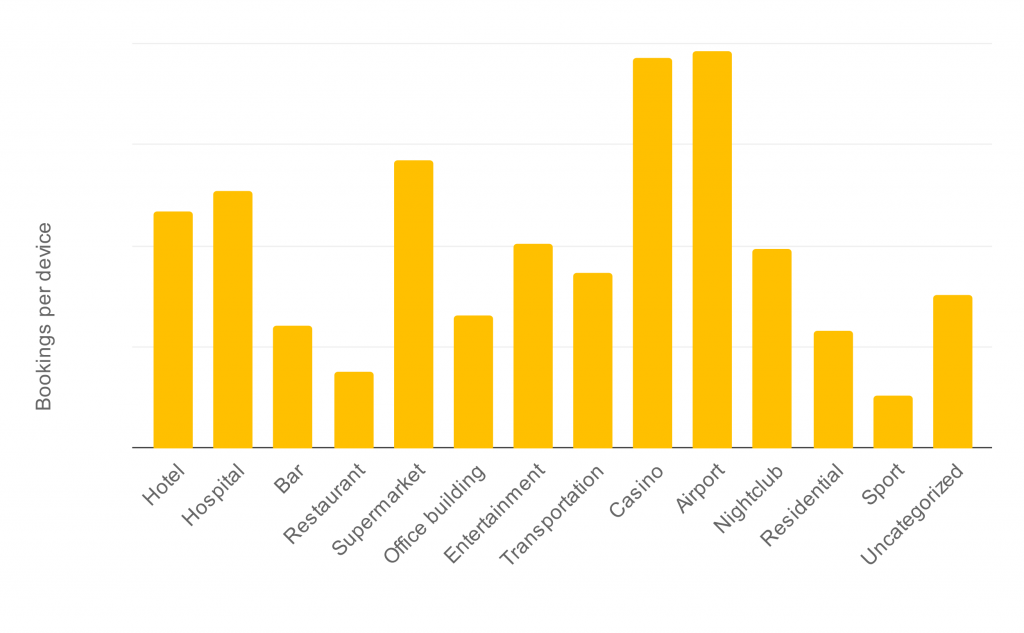

Graph #3: Bar chart comparing the average number of bookings between venue types.

Airports at the top ✈️

Airports ranked at the top of all venue types with the most average bookings.

Rankings compared

| # | Venue type | % Change | # Change |

|---|---|---|---|

| 1 | Airport | -36.5% | |

| 2 | Casino | -10.4% | |

| 3 | Supermarket | -6.5% | |

| 4 | Hospital | +3.7% | |

| 5 | Hotel | -17.7% |

Changes shown are since the last quarter.

A glance at the regions

Bookings per region

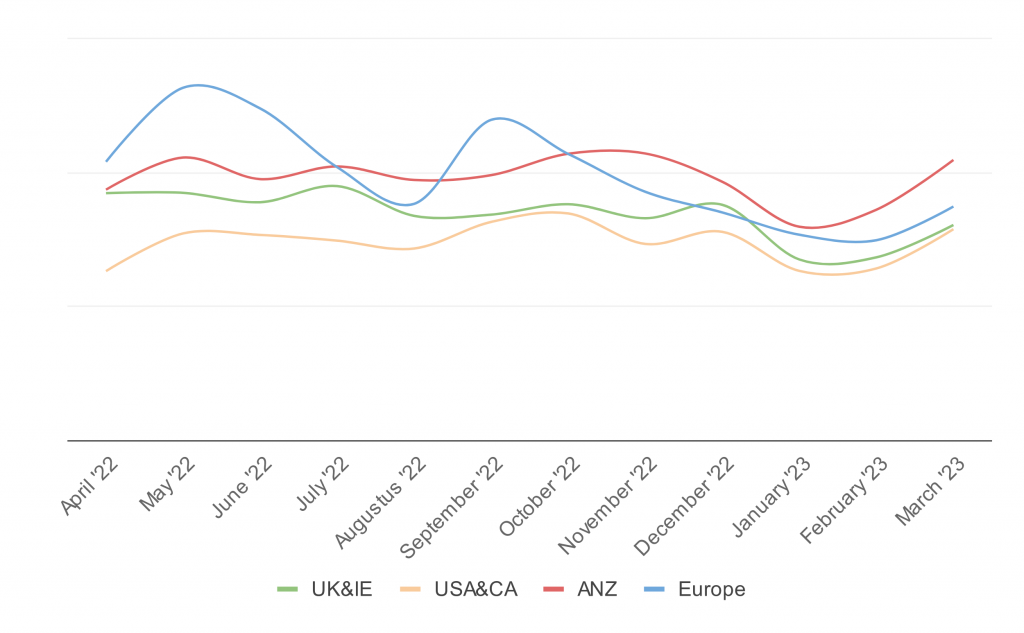

Graph #4: Line chart comparing the number of bookings between the regions.

2.8% growth for North America

North America saw 2.8% month-over-month growth last quarter, making it the highest of all regions. ANZ saw 1.6% growth, whilst Europe and UK&IE decreased by 0.2% and 0.7% respectively.

Rankings compared

| # | Region | % Change | # Change |

|---|---|---|---|

| 1 | North America | -12.5% | |

| 2 | ANZ | -12.9% | |

| 3 | Europe | -16.1% | |

| 4 | UK&IE | -16.5% |

Changes shown are since the last quarter.

Taxi booking data in your region ?

Use the buttons below to choose your region and see local data.

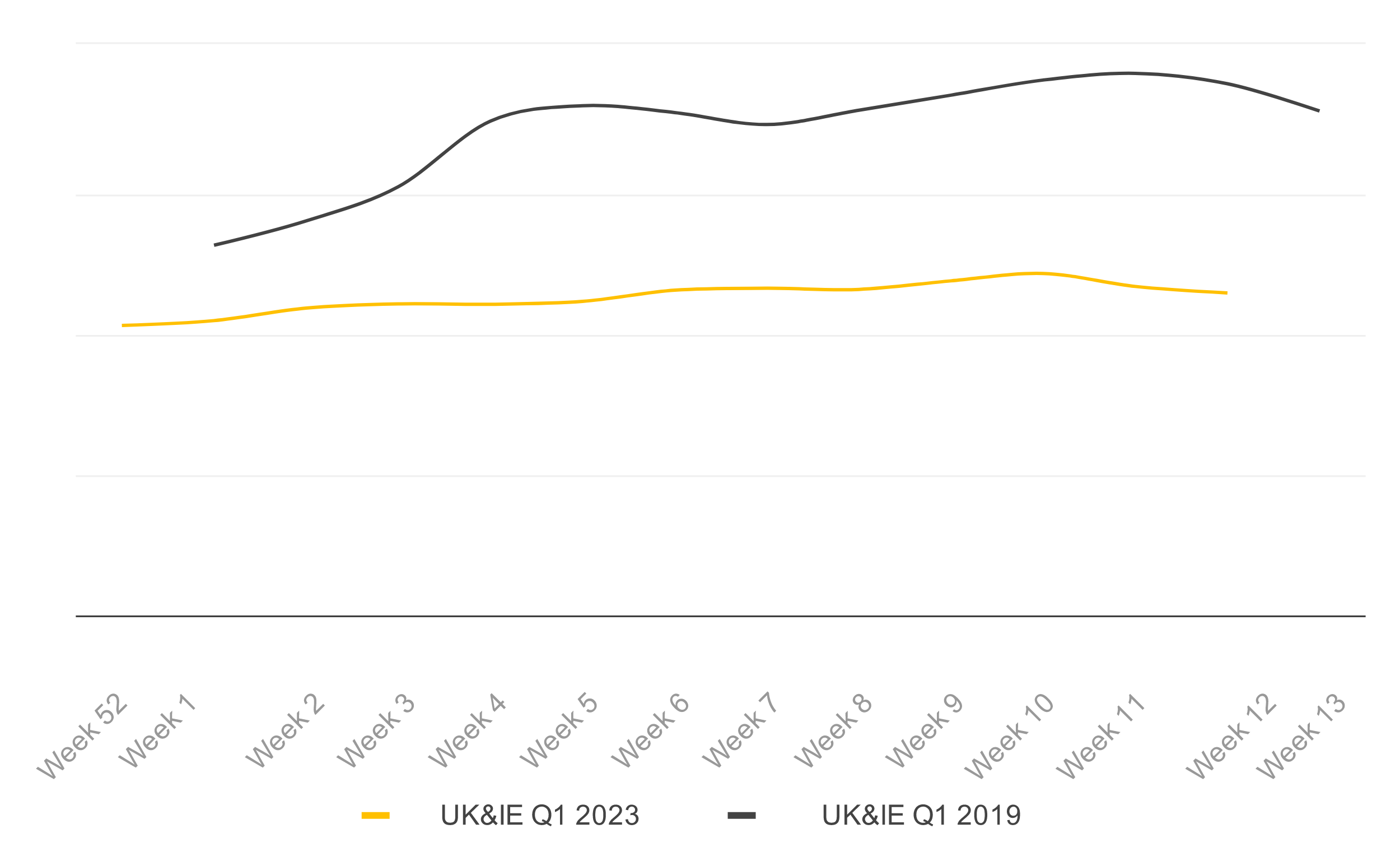

UK & Ireland 🇬🇧🇮🇪

Weekly B2B taxi bookings

Graph #5: Line chart showing the B2B taxi bookings for the selected region from last quarter on a weekly basis and a comparison line for 2019, the last pre-COVID year.

1.4% growth

Q1 2023 experienced an average week-over-week growth of 1.4%.

6.6% less than Q1 2022

Q1 2023 saw 6.6% fewer bookings than in the same quarter last year.

48.2% less than Q1 2019

Q1 2023 saw 48.2% fewer bookings than in the same quarter of 2019.

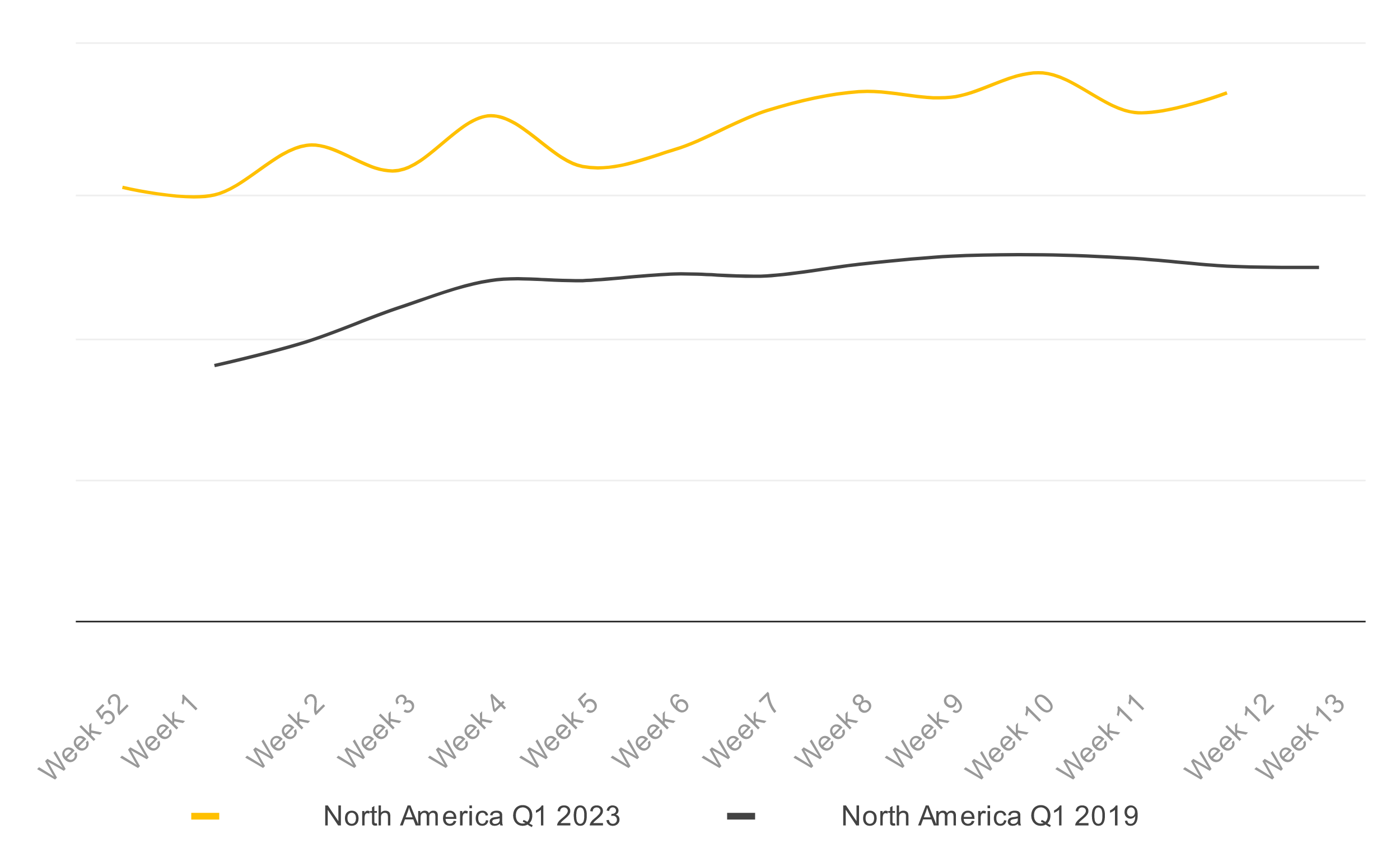

North America 🇺🇸🇨🇦

Weekly B2B taxi bookings

Graph #6: Line chart showing the B2B taxi bookings for the selected region from last quarter on a weekly basis and a comparison line for 2019, the last pre-COVID year.

2.2% growth

Q1 2023 experienced an average week-over-week growth of 2.2%.

63% more than Q1 2022

Q1 2023 saw 63% bookings than in the same quarter last year.

71.5% more than Q1 2019

Q1 2023 saw 71.5% more bookings than in the same quarter of 2019.

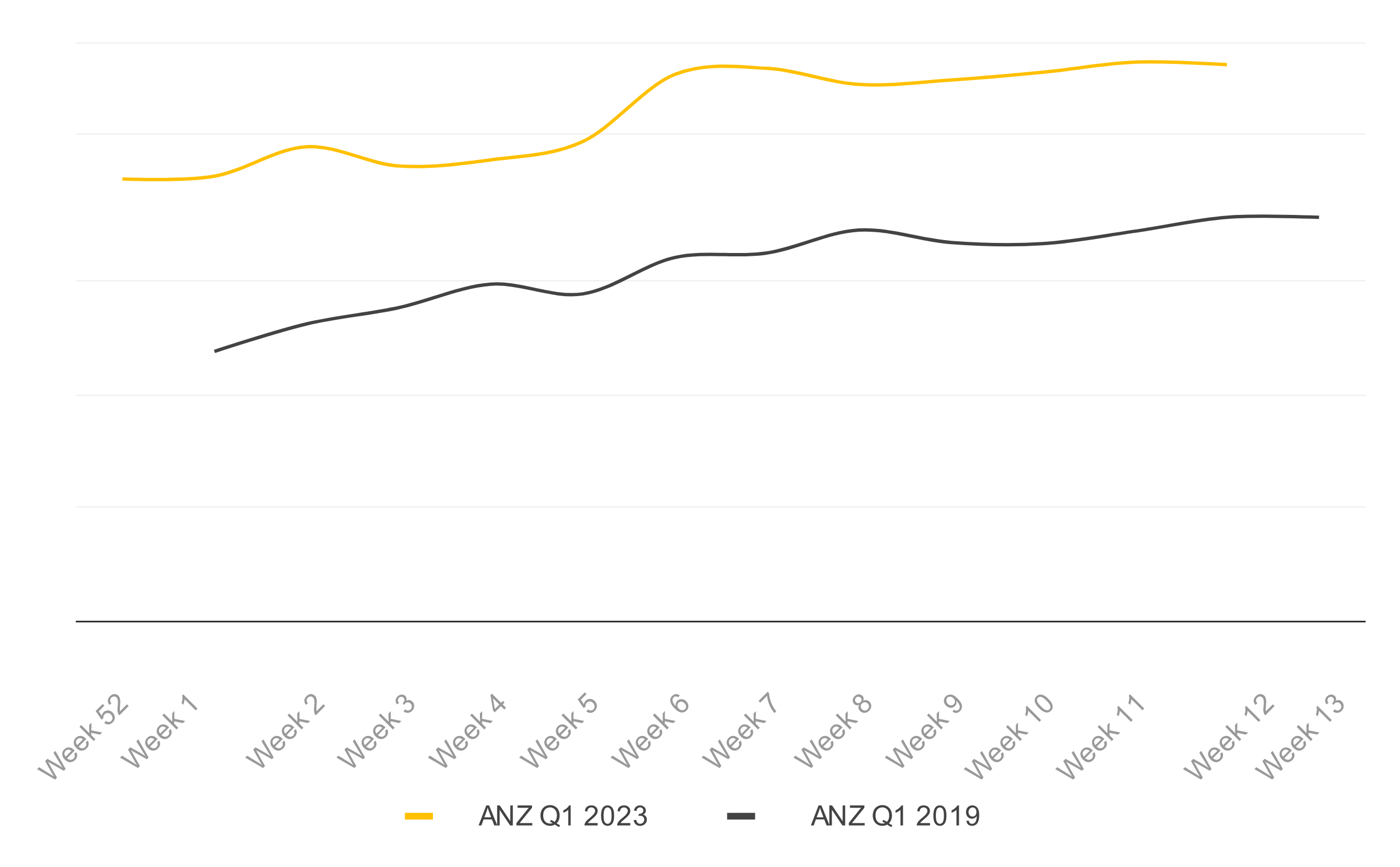

ANZ 🇦🇺🇳🇿

Weekly B2B taxi bookings

Graph #7: Line chart showing the B2B taxi bookings for the selected region from last quarter on a weekly basis and a comparison line for 2019, the last pre-COVID year.

2.53% growth

Q1 2023 experienced an average week-over-week growth of 2.53%.

22.5% more than Q1 2022

Q1 2023 saw 22.5% bookings than in the same quarter last year.

65.20% more than Q1 2019

Q1 2023 saw 65.2% more bookings than in the same quarter of 2019.

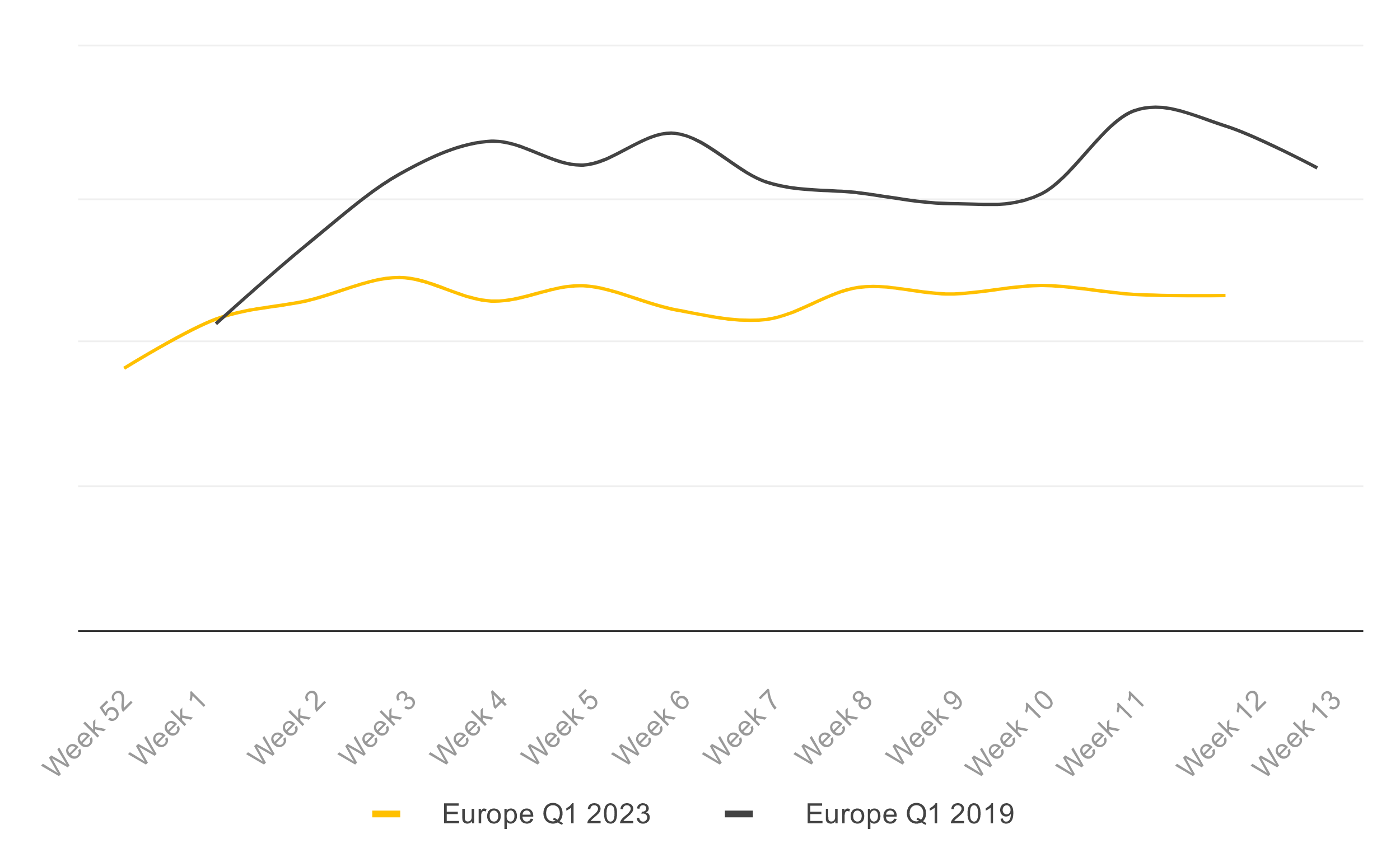

Europe 🇪🇺

Weekly B2B taxi bookings

Graph #8: Line chart showing the B2B taxi bookings for the selected region from last quarter on a weekly basis and a comparison line for 2019, the last pre-COVID year.

0.7% growth

Q1 2023 experienced an average week-over-week growth of 0.7%.

12.1% more than Q1 2019

Q1 2023 saw 12.1% more bookings than in the same quarter last year.

36% less than Q1 2019

Q1 2023 saw 36% fewer bookings than in the same quarter of 2019.

About this report 👏

Taxi Butler develops unique, purpose-built taxi booking technology that makes ordering taxis easier for venues like hotels, bars, and restaurants. Hundreds of fleets across the world use this technology to generate, automate and manage taxi bookings from their local venues.

The dataset presented includes the total number of successful taxi bookings made using Taxi Butlers, that are placed in venues (hotels, bars, restaurants, etc.) across the globe since 2019, by month, year, and country. For the dataset presenting comparisons between the different regions, the data has been aggregated and normalised. As Taxi Butler has a different amount of devices in each region, an absolute comparison was not possible. The data was averaged per device, per country, and then normalised using standard deviation and the mean. The remaining dataset is absolute, presenting the actual measured amount of bookings per year or month. The regions can be defined as follows:

- UK & Ireland: England, Scotland, Wales, Northern Ireland, and Ireland.

- North America: The United States of America and Canada

- Europe: Germany, Netherlands, Spain, France, Finland, Bulgaria, Romania, Denmark, Belgium, Poland, Austria, Portugal, Italy, and Switzerland

- All countries (52 in total): Great Britain, Australia, United States, Germany, Canada, Spain, Finland, Bulgaria, France, Denmark, Ireland, New Zealand, Netherlands, Romania, Belgium, Portugal, United Arab Emirates, Poland, Iceland, Austria, Oman, Montenegro, Latvia, Luxembourg, Sweden, Argentina, Turkey, Italy, Lithuania, Norway, Switzerland, Lebanon, Ukraine, Georgia, Somalia, Greece, Cyprus, Moldova, Maldives, Uruguay, Uzbekistan, Albania, Jordan, Curacao, Japan, Malta, Reunion, Brazil, Tajikistan, and American Samoa.

- B2B taxi booking

- A B2B taxi booking is a successful booking that has been placed by a Taxi Butler at a venue.

- Successful booking

- A successful booking is a booking that has been placed and accepted by a taxi driver and confirmed to have arrived at the desired location.

- Taxi Butler

- A taxi booking device that allows venue staff to book taxis for their guests in one click.

- Venues

- Venues can be any public business or place, where a taxi is booked from. The dataset primarily includes venue types like hotels, bars, restaurants, casinos and hospitals.

Disclaimer 🗒️

This report is intended for general guidance and information purposes only. The material in the report is obtained from various sources as per the methodology. We have taken reasonable care to ensure that, and to the best of our knowledge, material information contained herein is in accordance with the facts and contains no omission likely to affect its understanding. The estimates are subject to risks, uncertainties and other factors that may cause actual events to differ materially from any anticipated development. Please note that we make no assurance that the underlying forward-looking statements are free from errors. The information contained herein may be subject to changes without prior notice. Taxi Butler B.V. does not accept any form of liability, neither legally nor financially, for loss (direct or indirect) caused by the understanding and/or use of this report or its content.